Is Starhill Global REIT A Good Buy?

Starhill Global REIT is one of Singapore's smaller REITs with a market capitalization of $965 million. Their portfolio consists of 10 properties across Singapore, China, Japan, Australia, Malaysia valued at $3 billion as of June 2019. Their 2 notable properties in Singapore are Wisma Atria and Ngee Ann City. Starhill Global REIT's share price has decreased from $0.710 in February 2020 to $0.445 in August 2020 due to the COVID-19 pandemic. Most dividend investors in Singapore mainly focus on blue-chip dividend REITs as they are lower risks and relatively much more stable. However, small REITs such as Starhill Global REIT are able to offer more attractive dividend yields at a slightly higher risk. Should investors add this small-cap REIT to their portfolio given their low share price now?

Dividend History and Dividend Yield

Starhill Global REIT has a 15-year dividend history (>10 years). This means that they have been paying out dividends to shareholders consistently for 15 consecutive years. They have capable management that can guarantee dividend investors their dividend payout every year. Their average dividend yield from 2015-2019 was an impressive 10.9%, way higher than the average blue-chip REIT 4-6%. However, their dividend per unit has decreased by 33.9% from 4.48 cents in 2019 to 2.96 cents in 2020 due to the COVID-19 pandemic. Their estimated dividend yield for 2020 is 5.8%, which is still higher than some blue-chip dividend stocks. Starhill Global REIT's dividends are fairly sustainable as they are not borrowing debt to pay out their dividends nor are they paying out more than they earn. This reduction in dividend payouts for 2020 is a sign of good management as it shows that they are being prudent and making sure they are not overpaying.

Tenant Portfolio and Occupancy Rate

Starhill Global REIT has a relatively diverse tenant portfolio consisting of 10 mid-to-high-end properties over six cities in the Asia Pacific. This helps to reduce the risks associated with tenants defaulting on their rents or low rent turnover. Moreover, this prevents Starhill Global REIT to be too dependent on only a few tenants for their income which could be potentially risky if the few tenants do not pay their rent. Their top 10 tenants only contribute 57.9% of their total portfolio's gross rents. Starhill Global REIT has a total portfolio tenant occupancy rate of 96.2% (>90%) as of 30 June 2020 which is pretty high considering the impacts of the COVID-19 pandemic. The high tenant occupancy rate ensures that Starhill Global REIT is maximizing its properties to generate income and thus maximizing the amount of income available for distribution.

Debt Gearing Ratio

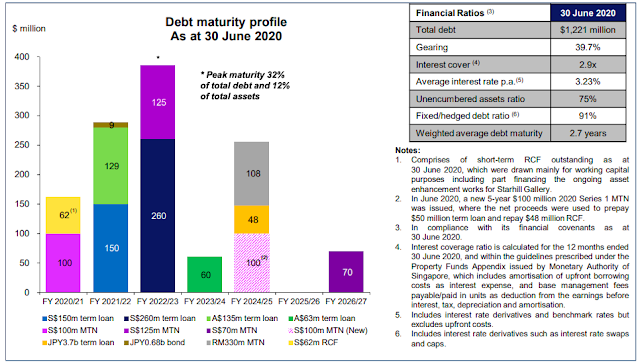

As of 30 June 2020, Starhill Global REIT has a debt gearing ratio of 39.7% (<40%). This is a relatively high debt gearing ratio for a Singapore REIT and is one of the reasons why smaller REITs have a slightly higher risk. Starhill Global REIT's high debt gearing ratio is largely a combination of the devaluation of their portfolio, increased borrowings to finance the improvement of Starhill Gallery and build cash balance to enhance liquidity for the COVID-19 pandemic. However, Starhill Global REIT does not have any term debt maturities in the next 12 months (as of 30 June 2020) except for $100 million medium-term notes due in February 2021 and a few short-term debts drawn under its revolving credit facilities. Furthermore, they have available undrawn credit facilities which are in excess of the maturing debts and can be drawn upon if needed. The Manager of Starhill Global REIT is exercising prudent capital management in this COVID-19 pandemic which is a good sign to investors as it reflects a well-managed REIT.

COVID-19 Impacts

Starhill Global REIT's net property income decreased by 12.4% from $142.5 million in 2019 to $124.8 million in 2020. This caused a 23.7% decrease in income available for distribution to shareholders from $101.3 million in 2019 to $77.4 million in 2020. As of 30 June 2020, Starhill Global REIT still has a relatively strong balance sheet with net assets ($1.7 billion) more than total liabilities ($1.3 billion). Despite the COVID-19 pandemic, Starhill Global REIT is still able to maintain a high tenant occupancy (>90%) rate for most of its properties across Asia-Pacific. Furthermore, its properties in Singapore are doing particularly well despite the pandemic with Ngee Ann City Property (Retail) being fully occupied of 30 June 2020 due to its prime location. With Australia, China and Malaysia also lifting most of their social restrictions, the worst seems to be over for Starhill Global REIT and it seems to be on track for recovering.

Verdict

In my opinion, I feel that Starhill Global REIT is one of the well managed small REITs in Singapore that dividend investors can consider adding to their portfolio despite its slightly higher risk (relatively high debt gearing ratio). It has a current Price to Book ratio of 0.54 at its current share price of $0.445, making it undervalued compared to its net total assets. If you have an appetite for slightly higher risk, you can look out for small REITs such as Starhill Global REIT.

Source: Starhill Global REIT's financial information

What are your thoughts on small Singapore REITs?

Comments

Post a Comment